Publicly listed companies typically report financial earning statements every three months or every six months or at the end of every financial year. Terms like ‘last twelve months’ or ‘trailing twelve months’ are frequently used in company financial statements. In reviewing figures shown as last twelve months or trailing twelve months, investors should not assume the figures necessarily coincide with a company’s most recent fiscal year. For example, in a financial statement dated March 2015, last twelve month figures cover the period of time from April 1, 2014, through March 31, 2015.

Sensata Technologies Reports Second Quarter 2023 Financial … – Business Wire

Sensata Technologies Reports Second Quarter 2023 Financial ….

Posted: Tue, 25 Jul 2023 10:00:00 GMT [source]

Last twelve month figures provide updated metrics from the typical annual and quarterly figures reported by company management. LTM stands for “Last Twelve Months” and is similar in meaning to TTM, or “Trailing Twelve Months.” LTM Revenue is a popular term used in the world of finance as a measurement of a company’s financial health. It reports or calculates the revenue figures for the “past 12 months.” LTM or TTM Revenue shows a company’s performance in the past year rather than just seeing the quarterly figures and adjusting it for the full year.

What is the Definition of Last Twelve Months (LTM)?

Last twelve months (LTM) refers to the timeframe of the immediately preceding 12 months. LTM is often used in reference to a financial metric used to evaluate a company’s performance, such as revenues or debt to equity (D/E). The terms « last twelve months » or « trailing twelve months » frequently appear in a company’s earnings reports or other financial statements. They can be calculated at any point in time by adding all the revenue generated in the previous twelve months. This provides a clearer picture of revenue growth, as it removes fluctuations due to seasonality or other temporary factors. The trailing twelve months technique can also be used to calculate other financial metrics and ratios.

However, the main difference between them is the starting point and the end point. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Working capital is essentially the money you need to keep yourself going in the time between…

Working Capital

Now that you know the difference between TTM and LTM, good luck with your financial calculations. Join one of our email newsletters and get the latest insights about selling your business in your inbox every week. Some examples of insider trading cases have been filed against company employees, friends and family members of employees, government officials and political intelligence consultants.

It can only be used in conjunction with more forward-looking relative valuation measures. TTM stands for ‘Trailing Twelve Months’ and it refers to calculations that show the most recent Twelve Months of Financial Performance (e.g. TTM Revenue and TTM EBITDA). LTM metrics are widely used throughout the Finance world, and you can follow our 3-Step Process ltm revenue meaning to calculate LTM Revenue, LTM EBITDA, or any LTM metric. These examples will help you understand how to source the data needed to calculate LTM Revenue and LTM EBITDA. Now, let’s walk through a couple of LTM calculations in action for Uber and Coinbase. So, if someone asks you to calculate TTM Revenue, it’s the same calculation as LTM Revenue.

In the US, company insiders are allowed to buy and sell company shares, but they must register all their transactions with the SEC. You now know what Trailing Twelve Months (TTM) or Last Twelve Months (LTM) revenue means and why it’s an important metric to consider. You know how to calculate TTM revenue, and you have seen examples of how to calculate it using Microsoft Excel or Google Sheets.

What are the types of insider trading?

Discover what Revenue Forecasting is, why it is crucial for every business, as well as the top forecasting methods to use and examples of each one. These aggregators then publish the average (or ‘Consensus’) of all the estimates submitted, which are used to create EV / NTM Revenue and EV / NTM EBITDA multiples. As a result, LTM Revenue and LTM EBITDA are not nearly as commonly used in Investment Management.

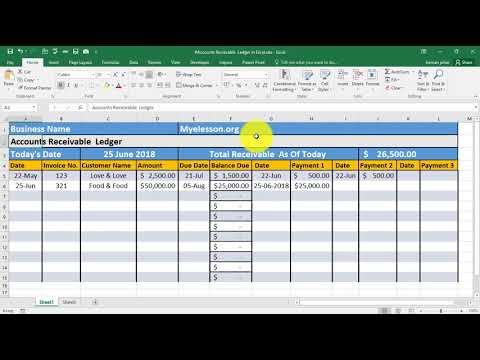

- The first step is to gather the relevant revenue data in your spreadsheet.

- As you can see in the screenshot above, the data is listed in reverse chronological order, with the most recent figure in the top row.

- If the company is publicly traded, the latest annual filing data can be found in its 10-K filings, whereas the most recent YTD and corresponding YTD financial metrics to deduct can be found in the 10-Q filings.

- However, if you’re calculating it for other companies, you may only have access to quarterly figures.

- Despite the shortcomings, the method finds its utility in valuation matrices used by the business while undertaking Mergers and Acquisitions and in normal parlance to analyze operational efficiency simultaneously.

The subsequent step is to source the corresponding quarterly revenue – i.e. revenue from Q-1 of 2020 – which we’ll assume was $2 billion. TTM is also often used by investment banks like Goldman Sachs and Morgan Stanley. This is because companies want the most up-to-date valuations of companies when carrying out large deals. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

Example: How To Calculate LTM EBITDA for Coinbase

This provides the most recent P/E figure, which gives a better basis for share price analysis. In both instances, these means the 12 months of financial results, regardless of what the company’s calendar year-end or fiscal year-end. LTM is important because it allows a company to compare year-to-date results to prior years. In this case, LTM does not correspond to a twelve months reference period starting as of “today” but it’s nonetheless close.

It is a popular valuation matrix that is an apt measure for companies with stable growth prospects and unaffected by personal bias on future projections as it is based on actual data. However, it lacks usage in companies with cyclical and seasonal impacts, limiting its usage. Despite the shortcomings, the method finds its utility in valuation matrices used by the business while undertaking Mergers and Acquisitions and in normal parlance to analyze operational efficiency simultaneously. Another instance where the last twelve months’ figures are useful is when a company is being considered for acquisition. To arrive at a more accurate current value of a company, last twelve months’ figures are often preferable to the most recent fiscal year figures.

In these reports, companies include financial statements like the income statement. Both LTM and TTM are useful figures to assess and analyze a company’s financial performance over a twelve-month reference period. TTM or Trailing Twelve Months provides financial data on a company’s financial performance in an annualized fashion by taking the immediately preceding twelve months.

What does LTM Revenue stand for?

Read on to learn the last twelve month definition and its meaning for investors when reading company financial statements. TTM or LTM revenue refers to the revenue earned by the company in the trailing twelve months (TTL), also known as the last twelve months (LTM). This provides more context for assessing the company’s growth and allows you to identify specific sources of growth. A company’s ability to generate revenue is essential to its success, and monitoring this metric can help to assess its current and future value. This is why there are so many financial metrics related to revenue, like total revenue, Monthly Recurring Revenue (MRR), or Annual Recurring Revenue (ARR).

- It may indicate the company is poised for revenue growth in the current financial year.

- For example, in a financial statement dated March 2015, last twelve month figures cover the period of time from April 1, 2014, through March 31, 2015.

- As you can see above, the fourth quarter (i.e. the Christmas Holidays) generates a significant portion of annual Revenue.

- This is why there are so many financial metrics related to revenue, like total revenue, Monthly Recurring Revenue (MRR), or Annual Recurring Revenue (ARR).

- In both instances, these means the 12 months of financial results, regardless of what the company’s calendar year-end or fiscal year-end.

- For example, a company may issue its financial statements on January 31st of a given year and provide LTM figures starting from January 1st of the year prior all the way to December 31st.

This could be potentially problematic if you take the value without doing any background research around it. A company could seem like it has historic revenue or catastrophic sales, but without context clues, you can’t assume that the pattern will continue. Therefore, it is the most accurate figure which can be used to depict current trends. One of the main benefits of calculating LTM is that it still includes 12 months of historical financial information, so any seasonal trends would still be factored in.

As you can see in the screenshot above, the data is listed in reverse chronological order, with the most recent figure in the top row. Now that you know how TTM revenue is calculated let’s see some examples of how to do it using Microsoft Excel or Google Sheets. The Annual Recurring Revenue (ARR) is a key metric for any subscription business.

ADT Corp. (ADT) Sells Commercial Business for $1.6B – StreetInsider.com

ADT Corp. (ADT) Sells Commercial Business for $1.6B.

Posted: Tue, 08 Aug 2023 10:57:46 GMT [source]

You’ll frequently see the terms “Last Twelve Months” or “Trailing Twelve Months” in a company’s financial statements or earnings reports. It provides a recent one-year performance of the business, which helps in averaging outlier quarters and provides a more concise view of the year’s performance comprising the last twelve months. This figure forms part of the company’s financial analysis report, and value is attached to the business based on multiple LTM EBITDA.