Setting a net terms interval should balance supporting buyers with flexibility and meeting your internal business needs and goals. Setting net terms that are too long may provide an unnecessary amount of free financing to buyers and jeopardize your internal cash flow. Defaulting on net terms can also harm relationships with existing suppliers. It can make it challenging to secure relationships with suppliers in the future.

- Once the Invoice is generated in Chargebee, upto 15 days from the Invoice date, i.e., 16th January, the status of the Invoice shall be Posted.

- For example, if you want to offer a 2% discount to customers who pay early, you can change the billing term to 2/10 net 30.

- If you are experiencing a difficult time with collections, there are still ways for you to collect your receivables and decrease your DSO (Days Sales Outstanding).

- Having available cash reserves will also allow companies to take advantage of discounts for early payments and clear debts with suppliers should business growth slow.

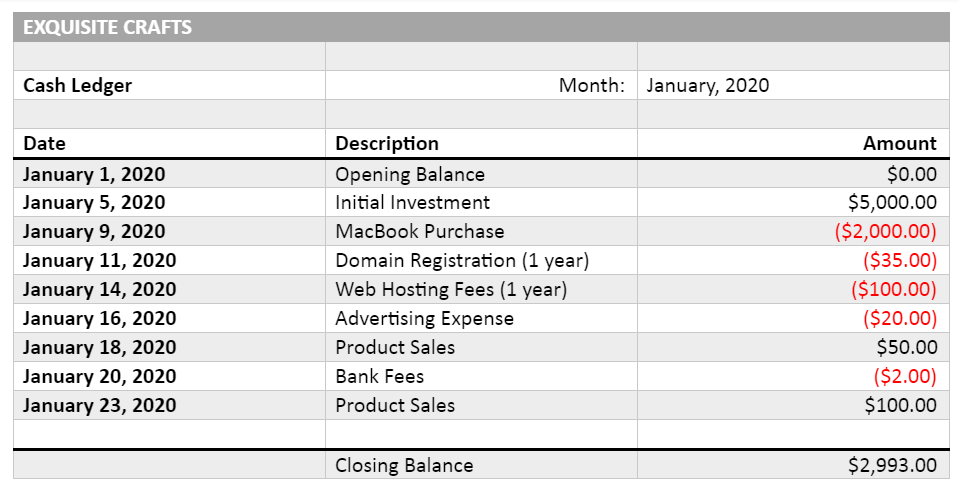

This means the invoice is due at the end of the month following the month of the invoice. For example, if you receive an invoice in December, you’ll need to pay it by the end of January. The following table contains a number of standard accounting payment terms, what they mean, and the effective annual interest rate being offered (if any). On the other hand, if one client often pays late, you might want to change it to a Net 15 instead of a Net 30. It’s not ideal for your customer, but it will incentivize them to pay on time to avoid late fees. Net terms are a way to offer customers favorable billing terms and can help you manage your cash flow—when set up properly.

How do net 30 payment terms work?

30 days, on the other hand, can be accompanied by a percentage in the place of “net,” which indicates a discount applied to the total of the invoice if the payee pays on time. Net 30 is a particular phrase that you can include on the payment terms of your invoice. It is used by vendors to specify the timeframe within which they wish to be paid. In the case of net 30, the payment period expected by the vendor is within 30 days.

- About half of all invoices issued by small businesses are paid at least two weeks late.

- Under these arrangements, clients get services today and are given a grace period (e.g., 30 days) before they’re expected to settle their accounts.

- A customer enjoys a 2% discount if the amount due is paid within 10 days of receiving the invoice.

- Other than the folks in accounts payable or procurement departments, executives are unaware if they have standardized their payment terms to suppliers.

- Delinquent payments from customers and slow periods can drastically reduce a company’s cash flow.

This figure will indicate the total percentage discount on the invoice prior to shipping or taxes that may be discounted upon early payment. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Make late payments a thing of the past by collecting payments automatically via ACH debit.

When payment is received, the receivable will be credited in the amount of the payment and the difference will be a credit to discounts taken. For a discount of 1%/10 net 30, it is assumed the 1% discount will be taken. This results in a receivable being debited for 99% of the total cost.

What is the Difference Between “Net 30” and “30 Days”?

Take a look at what other companies typically offer in your industry to determine whether you should offer net terms or not. Net terms can also help you build stronger client relationships over time. Net terms are often helpful to B2B companies that are also trying to manage and smooth their cash flow.

Find out how GoCardless can help you with ad hoc payments or recurring payments. Settle is an effective go-between for payers and vendors that helps to ensure they hit their net terms. It’s a modern, reliable cash flow management system that ensures every invoice is paid by its deadline. Take, for example, a company who has net-30 established with their vendor.

A customer’s continuing non-compliance with payment terms may lead to a supplier’s decision to stop offering credit terms to that customer. Thus, terms of « 1/10 » mean that a discount of 1% can be taken if payment is made within 10 days. Now, there’s no need to set a net term for every client and every invoice. You can customize them based on your industry, client’s history, cash flow, and how much you’re owed.

disadvantages of using net 30 payment terms

To reduce late payments, businesses should set manageable expectations around payment terms, including discount terms, end-of-month terms, or net terms, like Net 15, Net 30, Net 60, or Net 90. Whichever you prefer, knowing the ins and outs of payment terms like these can make or break your business. This shows that you understand their situation and want to build a win-win relationship with them. Net terms can be a door to new customers that will be loyal to purchasing from you for an extended period of time. Staying around your industry averages allows you to remain competitive on your net terms offer.

On the other hand, if you’re happy to offer more generous payment terms to your clients, think about offering net 60 or net 90 terms. A procurement management platform with flexible payment options helps buyers and sellers maximize their working capital. It facilitates access to a network of high-quality products and vendors, with terms that make it easier for businesses of any size to streamline their procurement and accounting processes. To deal with this reality, most business owners offering net payment terms also charge interest fees on late payments.

The answer to this question is critical in any business transaction, can be the source of tension between suppliers and their customers, and can make or break the health of a supply chain. Suppliers want the answer to be as soon as possible and customers want the answer to be as long as I can stretch this out. Effective net-terms management is key to maximizing liquidity for both buyers and suppliers. Once the transaction has been complete, the factoring company collects the payment from the creditor on the invoice, ending up with that one to two percent fee in profit. Or simply, your customers might want to know how long they have, to pay for your invoice, among the 30 other bills they receive every month. While customers may get confused about when the net 30 period starts, it’s always based on the invoice date.

What Does 1%/10 Net 30 Mean in a Bill’s Payment Terms?

Shorter DSOs are important to small businesses because they depend on shorter payment windows to maintain cash flow. Small businesses generally do not have large cash reserves so incoming cash is critical. Net 10, net 15 and net 30 are not only common invoice payment terms, they also function as a form of credit. It implies that goods and services have been provided and that the payee has been credited for those until a 30 day time period has passed, or in the case of net 10, within 10 days. Net 10 is a payment term that requires a client to pay in full for your product or service within 10 days of sending the invoice. This short payment term works best for small businesses with less available cash because it allows you to offer fair credit terms while bringing in cash much faster than Net 30 terms.

Operate Like a Bank

Other common invoice payment terms are Net 60, 1/10 Net 30 (1/10, n/30) and Due on receipt. A payment term is an indication on an invoice of how quickly a merchant expects to receive payment in full from a buyer. It implies that a product or service has been provided, with the expectation of payment at a later date.

You could explore offering a combination of net terms tailored to each customer. To do this efficiently, you need to use accounting software with invoice automation tools and reminders to ensure you don’t miss any due dates. The late payment fee is applied if the customer has 30 days to pay an invoice and fails to pay within the given date. However, customers benefit more by receiving products or services without paying upfront. It also allows them to make returns or cancellations without any financial commitments. Although the numbers are always interchangeable across vendors, the standard structure for offering a payment discount is the same.

In the world of B2B payments, everyone needs a little breathing room

The 1%/10 net 30 calculation is a way of providing cash discounts on purchases. It means that if the bill is paid within 10 days, there is a 1% discount. Delinquent payments can lead to a lower score, representing a higher financial risk. A lower business credit score can also make it Net terms more challenging to borrow from credit providers. Even though many small business owners don’t realize it, accepting payment at any point after a service is performed or goods are delivered is extending credit. In the U.K., the invoicing term “net 30, end of the month” is also common.